Are Argyle pink diamonds about to shoot up in value asks South China Morning Post

Rio Tinto’s Argyle mine in Western Australia, has dominated the pink diamond market, producing 90 per cent of the worlds supply, for the last 40 years. Nearing depletion and with imminent closure expected before the end of 2020, the price of these rare pink diamonds is expected to skyrocket.

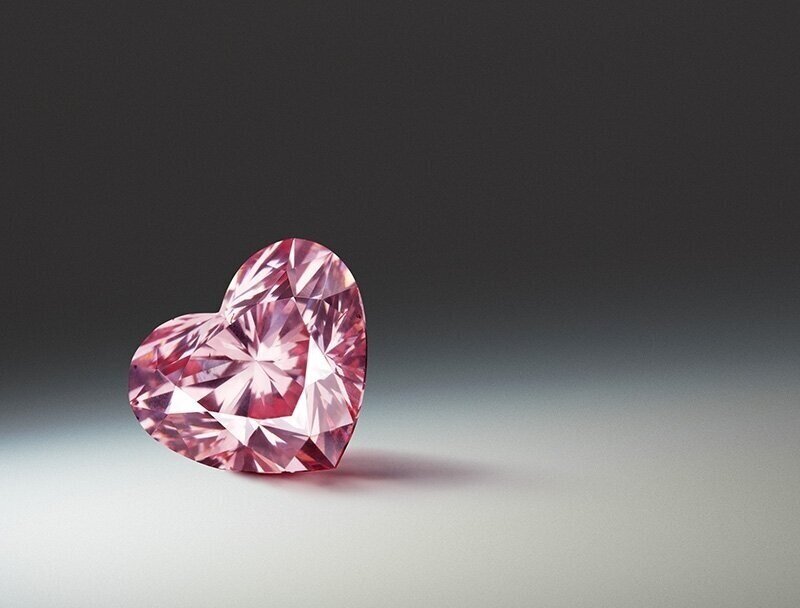

Pink diamonds are mostly purchased for investment purposes with a view to resale. With returns exceeding the stock markets, yields have produced around 10 per cent each year or 500 per cent over 20 years. Conversely collectors acquire and hold onto these alluring stones because of their exceptional rarity and beauty and have proven themselves to pay extraordinarily high prices. In 2017, a 59.6ct fancy vivid pink diamond named the ‘Pink Star’, sold at auction in Hong Kong for an astounding US$68.7m.

Whilst not the rarest of fancy coloured diamonds, pink diamonds remain a popular choice for jewellery lovers and with production of the Argyle mine down to zero, prices are expected to increase substantially.

Amma Asset Management currently holds 6 pink diamonds totalling 13.48 carats and with a current value in excess of $11m.