Latest News

Amma Group & Industry Related News

In The Press

Image: Laurent Boeki

Coloured diamonds - FT How to Spend It

Philip Baldwin, managing director and co-founder of Sciens Diamond Management and fund manager for Sciens Coloured Diamond Fund, explains, “We’re dealing here with the truly rarest of the rare. Prices for coloured diamonds haven’t fallen at a trade level since 1959, and in fact have gone up since then an average of 10-12 per cent per annum.” His private equity fund, which was set up in 2008 with partner Mahyar Makhzani and had a “handful of connoisseurs” as investors, now taps into a much larger investor pool that includes corporations and institutions.

Courtesy Rio Tinto

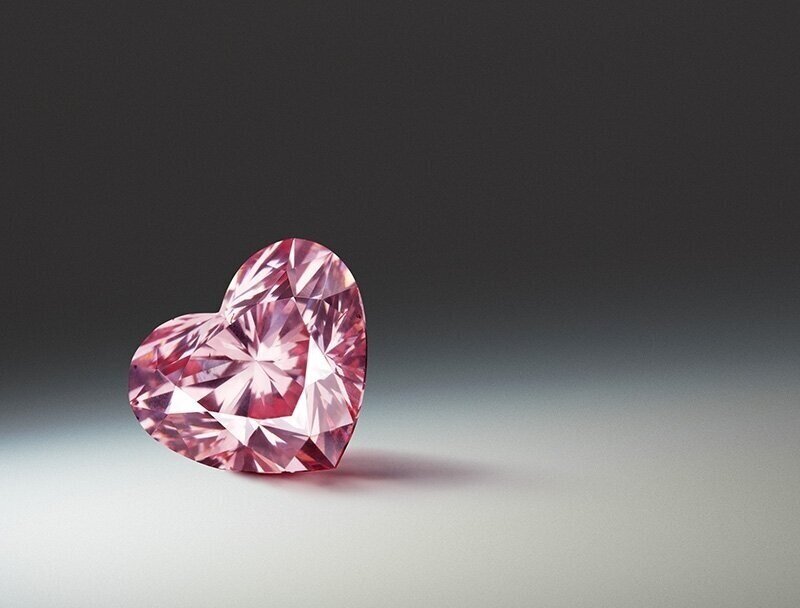

The last of the Argyle Pink Diamonds? - FT How to Spend It

…investment portfolio managers and funds such as Sciens Coloured Diamond Fund, for whom Argyle stones are key. Since 2000, these Tender stones have appreciated in price by 500 per cent, says Arnaud Soirat, CEO of Rio Tinto Copper & Diamonds, by far outperforming equity markets. Prospective buyers vie to acquire the “hero” stones of each Tender – the most extraordinary specimens, including the individually named reds and violets. It is estimated that only 150 Tender stones remain at the mine.

Jeffrey Hamilton | Stone | Getty Images

Investing in diamonds? Good luck getting prices - CNBC

Colorless diamonds are generally best for gifts, he said, while colored diamonds (pink, yellow, etc.) can be "assets with highly attractive investment" potential. Prices for a number of smaller colorless diamonds have fallen, while those for many colored diamonds have been stronger.

Makhzani's fund, which focuses on ultra-rare colored investment diamonds, is up 26 percent this year. It ended last year up 24 percent.

Here’s why you should be collecting diamonds - Robb Report

Founded in 2007 by Philip Baldwin and Mahyar Makhzani, the fund acquires and sells only top-quality colored diamonds. Since it was established, the fund reports, it has realized annual gains of more than 12 percent. “It’s been well documented that since 1959, colored diamonds have increased in price year after year, with gains on average of 10 to 12 percent per annum,” says Makhzani, who, with Baldwin, acquires the stones directly from the mines or from dealers and private collectors with whom he and his partner have longstanding relationships. One of their most prized stones is the Argyle Prima, a 1.2-carat fancy red diamond from the Argyle mine in Western Australia, with a value greater than $5 million.

Courtesy Christies

Gold is not all that glisters - diamonds act as hedge for the rich - Reuters

Entry level for Sciens Coloured Diamond Fund II, one of the more established closed-end funds now shut to new investors, is $1 million. It invests in diamonds in rare colors such as red.

The fund, which manages around $50 million, uses trading and buy-and-hold strategies for long-term appreciation. One of its strategies is to improve the value of stones by finding a rare matching pair in the same color, size and shape. They are eventually sold to buyers such as jewelers and collectors.

Image: Sim Kanety Clark

The new stone age - FT How to Spend It

It is also what prompted Philip Baldwin and Mahyar Makhzani, both with years of experience in high jewellery and diamonds, to set up a coloured-diamond fund 18 months ago. “It was perfect timing,” says Baldwin, “as coloured diamonds have seen such strong demand, particularly with the growth of markets in China, Hong Kong and India, as well as the Middle East. A vivid blue pear-shaped diamond of 7.96ct made $443,014 a carat in 1999; 10 years later, a comparable 7.03ct vivid blue stone fetched $1,349,752 a carat.”

How do coloured diamond form?

Mineral curator Mike Rumsey discusses the science behind the Aurora Pyramid of Hope, an unrivalled collection of 296 coloured diamonds.

Image: Amma Group

Demand Soars for Colored Diamonds - The Wall Street Journal

Last spring, Mahyar Makhzani, a Geneva-based fund manager, placed a 4.08-carat pear-shaped gem against special ultrawhite paper and peered at it through his eyeglass. He liked what he saw.

Several days later, after 10 minutes of negotiation on the telephone with the stone’s New York-based seller, Mr. Makhzani and a business partner bought the vivid-orange diamond for more than $1 million per carat.

Courtesy Sotheby’s

118-carat diamond could fetch $38 million - CNBC

Mahyar Makhzani, the London- and Geneva-based managing director of the Sciens Colored Diamond Fund, estimated that more than 80 percent of large-diamond sales over the past three years have gone to Asian buyers. Many of those buyers are newly rich Chinese, Singaporean and Indonesian millionaires and billionaires looking for a safe place to put their money.

"These are people with a lot of liquidity and there are not many places to park it that also have a chance of holding their value," Makhzani said.

Courtesy Rio Tinto

Rio Tinto Argyle Pink Diamonds Tender Achieves Highest Average Per-Carat Price - IDEX

The most valuable of the 65 rare pink and red diamonds from the Argyle mine was Number 1, Argyle Prima™, a 1.2-carat Fancy Red pear shaped-diamond, which the company said was tightly contested for its unique combination of size, shape, color and clarity. The diamond was won by Sciens Coloured Diamond Fund 11 BV, for an undisclosed value.