Non-Fungible Token Fancy Coloured Diamonds - Really?

After more than 12 months of relative inactivity, fancy coloured diamond prices are on the up according to data from the Fancy Colored Diamond Research Foundation (FCDRF), which shows changes in the wholesale price of all yellow, pink and blue fancy-coloured diamonds, irrespective of specific classifications, such as clarity, cut, tone and colour saturation.

This comes at the same time as the launch of the first public global tender of secondary market Australian Pink Diamonds by yourdiamonds.com, as well as the launch of Icecaps Investment Grade Diamond Non-Fungible Tokens, which are blockchain-based tokens that document ownership of assets.

Coloured diamonds are incredibly rare; approximately 1 in every 10,000 diamonds is considered fancy coloured, as stated by the Gemological Institute of America, the worlds most trusted name in diamond grading and gem identification. However, this poses a problem for the new diamond platform-based launches, as according to WWW International Diamond Consultants, at least 5,000 carats of similar attributes need to be traded to have a reliable gauge for a stones value, which given their scarcity, is impossible for fancy coloured diamonds.

Amma Group, fancy coloured diamond fund managers with over 60 years of experience in the diamond and luxury sector, set up its first fund 13 years ago. Open only to qualified purchasers and accredited investors, Amma Group believes that something of such high value and with general market opacity should not be traded by people or to people without the knowledge and expertise of fancy coloured diamonds, the necessary buying and selling procedures, transportation, safe keeping, insurance and naturally the financial regulations that must be followed when trading in this asset class.

Coloured diamonds range from brown, which is mostly used for industrial purposes, to yellow, through to orange, green, pink, blue, purple and the rarest of all, red. Of these colours, each is further classified by its intensity and depth of colour, the best of which is fancy intense to fancy vivid.

Unlike white, also known as colourless diamonds, whose increased value is attributed to the lack of colour, coloured diamonds attribute their value to the presence of colour, with fancy intense to fancy vivid being the most valuable.

“It takes in-depth knowledge and skill to know what you are dealing with.” said Mahyar Makhzani, Joint Founder and Managing Director of Amma Group. “For example, take a 1 carat Light Pink and a 1 carat Fancy Vivid Pink, assuming all other characteristics are the same, there could be a price differentiation of 100 times.”

Philip Baldwin, Joint Founder and Managing Director of Amma Group added “We only ever buy and sell stones with certification that is no more than 6 months old. Even as experts, seeing a certificate is just part of the story. We also ensure a realistic net asset value ‘NAV’ by gaining valuations from three independent coloured diamond experts on a quarterly basis.”

Fancy coloured diamonds are a natural and therefore exhaustible resource. With scarcity and rarity constantly increasing, prices at auction have shown a steady rise over the last decade and more. This combined with over 60 years of knowledge and skill along with some interesting buying and selling strategies have resulted in Amma Group receiving some notable recommendations with one client saying, “The Coloured Diamond Fund produced impressive returns with the additional attraction that they were not correlated to those of traditional mainstream asset classes.”

Makhzani went on to say “We bought one stone, with a per carat price of $500,000. We thought that if we re-cut and polished it, in other words, reduced its size, we might be able to achieve a better, more intense colour. We did just that; it was re-certified and sold for a per carat price of over $3.5m.”

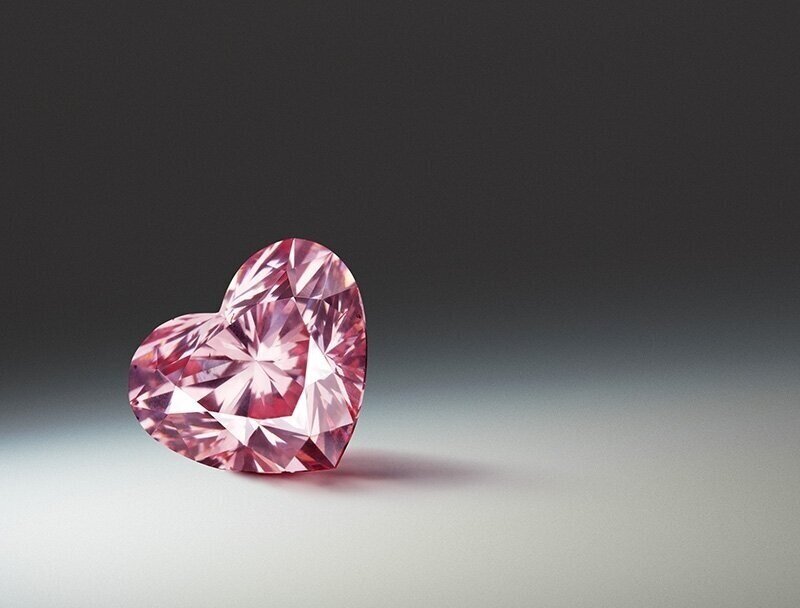

With the depletion and subsequent closure of the Argyle mine in Australia, which was the source of 90% of the world’s pink diamonds, prices for one of the rarest of coloured diamonds are expected to increase, but as Baldwin ends, “With such opacity in the coloured diamond market, you really have to be knowledgeable about what you are buying and from whom.”

Pink Diamond Colour Scale by Scarcity & Value

The graph shows how scarcity and value are impacted across the colour scale spectrum.

The Argyle Prima© Fancy Red Pear Shaped Diamond

Previously under management by Amma Group

The Argyle Mine Ceases Operations Today

After 37 years and more than 865 million carats of rough diamonds, a very small proportion of which have been pink, the Argyle mine will finally close today.

The Argyle mine has been the source of 90 per cent of the world's pink diamonds over the last thirty years and in that time, pink diamonds have gone up in value by more than 500 per cent. Rio Tinto's managing director for operations, copper and diamonds, Sinead Kaufman said "Demand for Argyle pink diamonds has continued unabated. Rarity, uniqueness and a finite supply has driven the strong value appreciation we have seen, and continue to see."

Described by Vivienne Becker, award winning jewellery writer and historian, as having "a colour and quality that had never been seen before." Much like white diamonds, coloured diamonds are categorised according to their colour which range from very light through to vivid and intense - the more vibrant and intense the colour, the rarer and therefore, the more valuable. What has made Argyle Pink Diamonds so extraordinary is the sheer number of stones with the richness and vibrancy of colour, sitting in the far end of the colour spectrum. "It was completely unprecedented and there was massive excitement in the industry," said Becker.

Mahyar Makhzani, Managing Director and Co-founder of Amma Group commented that we expect prices to climb further after the mines closure. "Pink diamonds have out-performed virtually all traditional asset classes over the past 10 to 15 years," he said. "They've done better than the stock market, property, precious metals and really do present a very stable asset class.”

"The market has known for a long time now that the mine is closing so I don't think we're going to see any shock movement but certainly in a year or two the supply squeeze will start to be felt quite significantly and we’ll expect to see pink diamonds really increase in value. It would be true to say that if you have an Argyle Pink Diamond, then you should hold onto it, but if you are looking to invest, do it now rather than wait a couple of years," said Makhzani.

The land that these diamonds originate from is well known to be sacred land and as Vivienne Becker mentioned, "A huge part of the appeal of these diamonds is the provenance, the purity and integrity of the provenance."

"We've lived through the life of this mine, right from the start, and in these days, when people are really concerned with the origins of every product they buy, particularly luxuries, then this has been a very important element," she commented.

The term conflict diamonds is well known and for a long time now, mines have signed up to the Kimberley process, ensuring diamonds are conflict free. However less well known are the environmental, social and governance (ESG) concerns surrounding the industry. In a desire to ensure traceability of its diamonds, Amma Group has recently partnered with The Loudhailer to support and connect digital futureshapers whose innovations might address these concerns.

“With an intention to work with partners to improve social, economic and environmental factors within the diamond and precious stone industry, Amma Group through is partnership with The Loudhailer is developing a fund structure to further support winners of the African based Global Startup Awards, also providing the business tools needed to succeed. Inevitably these digital disruptors will pave the way in addressing climate change, sustainability metrics and energy”, said Philip Baldwin, Managing Director and Co-Founder of Amma Group.

Amma Group has been one of a handful of organisations around the world that are invited to the yearly Argyle Pink Diamonds Tender - the chance to bid on stones from the Argyle mine, 2020 being its penultimate Tender. The process follows the format of a blind auction; organisations have a limited time frame in which to present their best and final offer on a stone in the hope that they come out on top. Amma Group has been fortunate enough to have purchased a number of stones from the Tender, over the last decade.

The Argyle Mine will close today, Tuesday 3rd November and Rio Tinto will begin a five-year process to decommission it before returning the land to its Traditional Owners.

In celebration of the the Argyle Mine and its treasure trove of pink diamonds, below is a wonderful podcast from The Sydney Morning Herald, Good Weekend Talks.

Thank you Argyle Pink Diamonds; ours is the richer for having known you!

Amma Asset Management Delighted to Announce Realisation of Sciens Coloured Diamond Fund III

…the fund was completely realised with a 25% net return, over a 26 month purchase period…

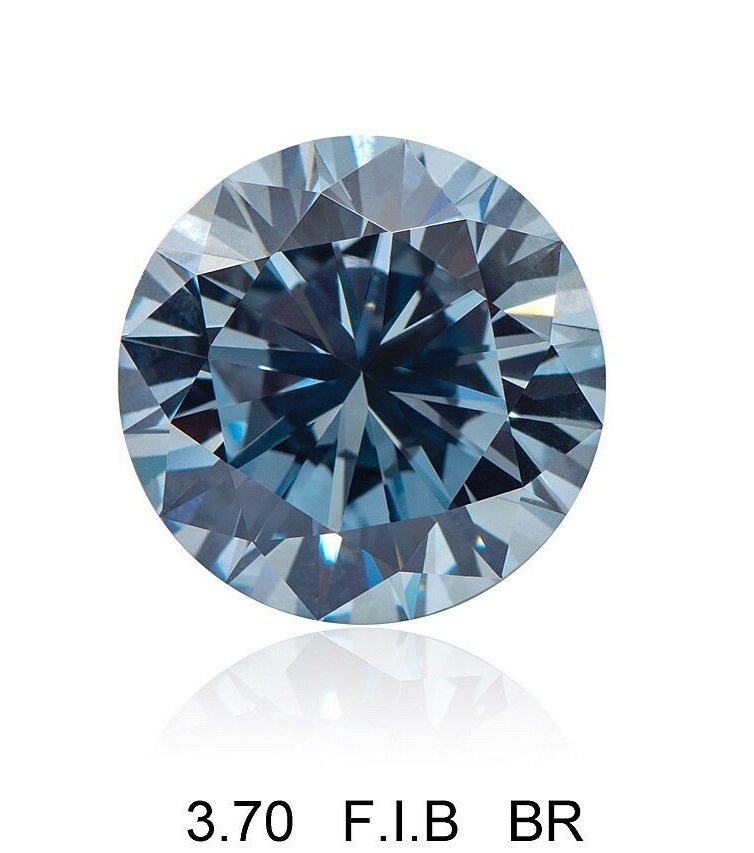

Launched in Q4, 2017 and originally comprising 7 diamonds of 15.33cts, fund III included a 1.20ct, Fancy Vivid Green, Round Brilliant cut and a 1.14ct Fancy Red, Modified Rectangular cut, both of which are considered to be amongst the rarest stones on earth. Also included within the fund were three fancy blue diamonds and two fancy pink diamonds.

Since inception, the fund has predominantly outperformed the stock market and far exceeded bonds, gold and colourless diamonds.

With one stone already sold, the fund was completely realised during Q1 2020 with a 25% net return, over a 26 month purchase period, representing NAV.

Decrease in global diamond production creates demand amongst India’s super rich

It is well-known that the primary source of the rarest pink diamonds in the world, Rio Tinto’s Argyle mine in Australia, will close its operations imminently. Less well-known is the pre-pandemic expected decline of around 8% of total rough diamonds mined, starting in 2021. In Bain’s 2019 Global Diamond Industry Report, it states annual production of rough diamonds is expected to decline in Canada, Botswana, Australia and South Africa.

The anticipated reduced production, combined with the estimated 20% Covid-related drop in rough output this year, may push up diamond prices further in the near future. And with coloured diamonds representing just 0.001% of the total rough diamonds mined, the value of these exceptionally rare stones is foreseen to skyrocket as supply falls.

Indian based diamond traders have commented that the demand for Argyle pink diamonds has shot up by three times amongst high net worth Indians compared to the same period last year.

Over the last decade up to 2017, the average price paid at auction for coloured diamonds increased by 122% with Argyle diamonds demanding a further 10 - 20% on top. Argyle diamonds can reach in excess of $5 million per carat depending upon the size and clarity. The mine holds an annual invitation-only Argyle Pink Diamond Tender in which it showcases its best pink, red, and blue stones from the preceding year. Over the last decade, Philip Baldwin and Mahyar Makhzani have been invited to the Tender and have previously purchased three Argyle red diamonds, the Argyle Isla, Aurora and Prima, one of which sold with a Gross Return of 1.6x, with a 38% IRR (internal rate of return).

Argyle Pink Diamonds releases one of it’s final collection Tenders.

Named One Lifetime, One Encounter, the Argyle Pink Diamonds Tender is expected to be one of its final collections before the mine’s eventual closure.

Comprising 62 loose diamonds, weighing 57.23 carats, this year’s Tender also includes additional Petite Suites - 12 sets of small pink, red, blue and violet diamonds, collected over the past five years and weighing 13.90 carats.

Within the loose stones, there are six hero diamonds including the Argyle Eternity – weighing 2.24 carats, it is the largest fancy vivid round brilliant diamond ever offered at the Tender, and the sixth largest Fancy Vivid diamond of any shape.

Arnaud Soirat, chief executive Rio Tinto Copper & Diamonds commented that “Rio Tinto’s Argyle Mine is the first and only ongoing source of rare pink, red and violet diamonds in the world. We have seen, and continue to see, strong demand for these highly coveted diamonds, which together with extremely limited global supply, supports the significant value appreciation for Argyle pink diamonds”

Amma Asset Management currently holds one Argyle diamond, a 1.14 carat Fancy Red, Rectangular Brilliant shaped diamond.

The Argyle Pink Diamonds Tender 2020 Heroes

Courtesy Argyle Pink Diamonds, Rio Tinto

With the Argyle closure looming, Ellendale provides hope for Australian coloured diamonds

Western Australia is one step closer to a new source of coloured diamonds, following a significant discovery at the Ellendale diamond field.

India Bore Diamond Holdings revealed it had unearthed a large deposit of rare diamonds on a site which had once produced half the world's supply of fancy yellows.

Ellendale exploration had been mothballed until the recent discovery which targets a riverbed formed some 22 million years ago and is estimated to contain over a million carats of gem-quality diamonds.

Most interesting is that after analysis, the stones appear to display a purple florecence under ultraviolet light, something which only occurs in around 30 per cent of diamonds and a characteristic rarely seen in fancy yellows.

Whilst yellow diamonds are typically valued at up to four times that of a white diamond of a similar size and quality, a pink diamond can reach up 50 times the price.

Alas whilst renewed exploration is very encouraging, it is unlikely that there will ever be another mine that equals the success of the Argyle.

Courtesy Rio Tinto

Are Argyle pink diamonds about to shoot up in value asks South China Morning Post

Rio Tinto’s Argyle mine in Western Australia, has dominated the pink diamond market, producing 90 per cent of the worlds supply, for the last 40 years. Nearing depletion and with imminent closure expected before the end of 2020, the price of these rare pink diamonds is expected to skyrocket.

Pink diamonds are mostly purchased for investment purposes with a view to resale. With returns exceeding the stock markets, yields have produced around 10 per cent each year or 500 per cent over 20 years. Conversely collectors acquire and hold onto these alluring stones because of their exceptional rarity and beauty and have proven themselves to pay extraordinarily high prices. In 2017, a 59.6ct fancy vivid pink diamond named the ‘Pink Star’, sold at auction in Hong Kong for an astounding US$68.7m.

Whilst not the rarest of fancy coloured diamonds, pink diamonds remain a popular choice for jewellery lovers and with production of the Argyle mine down to zero, prices are expected to increase substantially.

Amma Asset Management currently holds 6 pink diamonds totalling 13.48 carats and with a current value in excess of $11m.