With changes in the major watch & jewellery fairs, just how important is brand diagnosis?

In July we wrote about the impending changes to MCH Group, organisers of Baselworld. Since then Baselworld has been shelved and replaced by HourUniverse. Described as ‘a new hybrid platform for the watch, jewellery and gemstone industries,’ with one live show to be held in Basel each year, the new approach and platform is a result of ‘industry feedback and current challenges’ facing the world. But is this a knee-jerk reaction to the loss of some major brands from the show? Certainly consumer feedback is integral to any strategic decision-making, however any expert in strategy will tell you that effective diagnosis and the subsequent tactical implementation should never be rushed.

No greater example of the effectiveness of diagnosis comes from Gucci. In 2004, after the departure of Tom Ford and Domenico De Sole, Gucci Group sent shockwaves around the world of luxury by appointing Robert Polet as its new CEO. Previously from Unilever, the headlines read ‘What do frozen fish and ice cream have to do with $8,000 crocodile handbags? Robert Polet is about to find out.’ Gucci Group made a seemingly unthinkable move and chose talent and ability over knowledge of the market, trusting that Polet would use his skill to do the appropriate diagnosis in order to create a strategy and implement it. Many scoffed not only at his appointment but also at his start date - July 1st, just as the entire European luxury industry was heading off on holiday! But whilst the luxury industry was sleeping Polet was doing his diagnosis, giving him time to think, learn and understand. He appreciated that proper diagnosis takes time and it was this ability that enabled him to double revenues and triple profits.

We very much hope that we are wrong, but we suspect that Baselworld under its new guise of HourUniverse will result in little change.

Credit MCH Group

Internally Flawless Fancy Intense Blue to Lead at Christie’s New York

Christie’s New York is to host their Magnificent Jewels auction on the 29th July at the Rockefeller Center.

Centre stage will be a 7.16 carat Fancy Intense Blue Internally Flawless, Pear-shaped Diamond Ring with an estimate of $3.5 - 5 million.

In addition to a number of yellow diamonds is an unheated and untreated 8.54 carat Kashmir Sapphire

The sale along with another in London are Christie’s first live jewellery auctions to take place since the start of the global pandemic. The inclusion of such a significant piece, with an estimate akin to the pre-pandemic prices, is extremely encouraging for investors of fancy coloured diamonds.

A blue diamond ring to lead Christie's sale of magnificent jewels in New York on July 29.

Courtesy of Christie's

Baselworld asks investors to accept rescue package

Lupa Systems, an investment company run by James Murdoch, younger son of Rupert Murdoch, has put forward a rescue package to MCH Group AG, owners of Baselworld and Art Basel to save the company, following the impacts of Coronavirus and the exit of Rolex, Bulgari and the Swatch Group from the show.

According to Bloomberg, with the abandonment of such major players from the show, combined with the cancellation of both Baselworld and Art Basel this year, the MCH Group is anticipating a fall in sales of up to $180 million.

The deal with Lupa Systems is thought to be of around CHF 100 million for 30-44% of the group and at an Extraordinary General Meeting to be held on 3 August 2020, the election of James R. Murdoch (Founder and CEO Lupa Systems), Jeff Palker (Managing Partner and General Counsel Lupa Systems) and Eleni Lionaki (Partner Lupa Systems) to the Board of Directors will be proposed.

In addition to the capital increase, the Canton of Basel-Land and the Basler Kantonalbank have offered to extend the repayment period of their CHF 35 million and CHF 40 million loans by five years.

In a bid for financial and structural strengthening to overcome the corona crisis and implement the long-term strategy MCH Group has said that “If this overall package were to fail, extremely little time would be left for developing and implementing alternative restructuring solutions before it was too late.”

Baselworld, MCH Group

Fancy Vivid Blue Leads At Christies Geneva Auction

Today, top lot at Christie’s Geneva Magnificent Jewels auction was an internally flawless 5.34-carat fancy vivid blue modified brilliant-cut diamond and white diamond ring. Estimated at between $8.5 and 12.8m, the ring sold for $9,334,394.

Also of note were three Kashmir Sapphires and four Burmese Rubies which all either met the estimate given or in some cases more than doubled the top estimate given. This is very promising for Amma Asset Management, which intends to launch its fifth fund in 2020 with the inclusion of Royal Blue colour Kashmir Sapphires and Pigeon Blood colour Burmese Rubies to the already impressive assortment of fancy coloured diamonds.

Fancy coloured diamonds remain strong during economic downturn

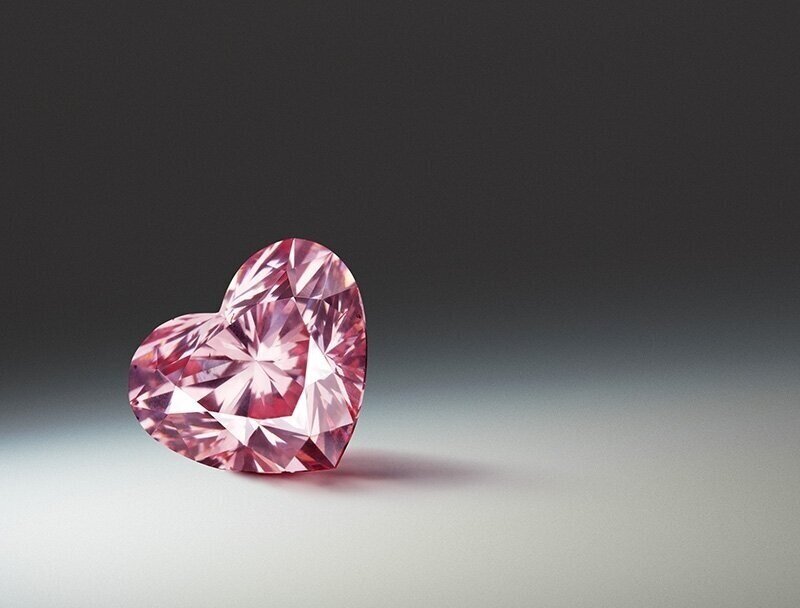

On the 10th July 2020, during one the first live auctions to be held by Sotheby’s Hong Kong, since the lifting of lockdown, a 4.49 carat fancy vivid pink heart-shaped diamond ring and a 5.04 carat fancy vivid blue heart-shaped diamond ring sold for a combined $18.6 million.

The vivid pink was internally flawless, set on a white gold ring and flanked by two pear-shaped diamonds and achieved more than $8.1m.

The vivid blue diamond with VS2 clarity, mounted on a platinum ring and flanked by two pear-shaped diamonds achieved more than $10.5m.

Also sold at the auction were several other, but less important, fancy coloured diamonds from yellows, through to pinks, blues and greens.

The auction represents the first significant sales of fancy coloured diamonds since the start of the Covid-19 pandemic at the beginning of 2020. The positive results are not only encouraging but also confirm the class’s ability to remain strong during economic downturns.

Dramatic changes for Baselworld

In the heart of Switzerland lies Basel, home of Baselworld, the global watchmaking, jewellery, gemstone and related industries trade show. For over a century, Baseleworld has been a must-attend show for major brands, discerning buyers and influential press from around the world. An opportunity for this community to unite and discover first-hand, new trends and innovations launched by top brands.

Run over 6 days with 82,000 visitors and over 3,500 journalists, Baselworld has suffered a blow over the last 18 months with major brands including Bulgari, The Swatch Group and most recently Rolex, confirming that they will no longer participate in the show.

With over 60 gem specialists still participating, the show will remain an important opportunity for Amma Group to view and purchase stones. However, like so many organisations going forward, Baselworld will be judged on its agility and ability to innovate in order to find a ‘new normal.’

Are Argyle pink diamonds about to shoot up in value asks South China Morning Post

Rio Tinto’s Argyle mine in Western Australia, has dominated the pink diamond market, producing 90 per cent of the worlds supply, for the last 40 years. Nearing depletion and with imminent closure expected before the end of 2020, the price of these rare pink diamonds is expected to skyrocket.

Pink diamonds are mostly purchased for investment purposes with a view to resale. With returns exceeding the stock markets, yields have produced around 10 per cent each year or 500 per cent over 20 years. Conversely collectors acquire and hold onto these alluring stones because of their exceptional rarity and beauty and have proven themselves to pay extraordinarily high prices. In 2017, a 59.6ct fancy vivid pink diamond named the ‘Pink Star’, sold at auction in Hong Kong for an astounding US$68.7m.

Whilst not the rarest of fancy coloured diamonds, pink diamonds remain a popular choice for jewellery lovers and with production of the Argyle mine down to zero, prices are expected to increase substantially.

Amma Asset Management currently holds 6 pink diamonds totalling 13.48 carats and with a current value in excess of $11m.