What the Crypto are diamond NFTs?

With the recent sale of a 101ct diamond at Sotheby’s being purchased by a Cryptobuyer, we wanted to get our heads around the emerging world of Cryptocurrency and more specifically diamonds being sold as NFTs.

An NFT or non-fungible token, provides digital proof of ownership and thereby receipt of a unique asset. Whilst the token or file, is digital, the assets that the token represents can be both digital and non-digital.

NFTs are built on blockchain, technology that effectively acts as a digital ledger. From mine to consumer, a diamonds form changes from rough to cut, frequently passing through numerous hands and many continents before it gets to the end consumer; therefore, having a digital record of its life story is very helpful. For example, it was recently reported during a meeting of the Kimberley Process, that a number of countries are still using the sale of rough diamonds to fund violence by the ruling authorities, which is still allowed under KP rules, as opposed to the funding of rebel groups, which is not allowed – semantics, but important and not in the spirit of the agreement - therefore, in this instance, surely blockchain technology could offer a better, much more enforceable and transparent solution?

One of the arguments for NFTs is that not only do they embed information within the digital file that acts as property rights, but they also remove the need for ‘middle-men’. However, by removing the middleman, you are also presumably removing pertinent regulations and considerations for what is ‘appropriate’ and ‘transparent’ trading?

“As owners of a fund specialising in fancy-coloured diamonds, our processes are under a huge amount of scrutiny and regulatory processes; and that is fine, that is what we want it to be. Our concern however is that, with all the hype around NFTs there are a number of marketplaces which could, or in some cases already are, selling diamonds and other collectible assets at hugely inflated prices. There appears to be trust in NFTs, but without knowledge of a diamonds worth,” said Mahyar Makhzani, Co-Founder and Joint Managing Director of Amma Group.

As a fund that is required to provide four independent valuations of its diamonds on a quarterly basis, we wanted to understand how a diamond NFTs initial value is established therefore, we decided to look more closely at Opensea, and their NFT platform for diamonds.

Established in 2017, Opensea is a peer-to-peer marketplace for NFTs. In 2020, Opensea launched Icecap, an NFT platform for diamonds. With a stellar leadership team combining extensive knowledge across the diamond and cryptocurrency sectors, this very much looks like a platform that can be trusted, but we wanted to use our in-depth knowledge of diamonds to put their theory to the test.

Icecap has what they call a Value Index, currently in BETA, which guides the seller to a suggested price based on an average wholesale price plus a 1.5 multiplier, to create a theoretical (and presumably realistic) “investor price level.” Icecap then compares the asking price on every diamond listed, to the suggested investor price at that moment in time, to establish which diamond NFTs are selling below or above the proposed value.

This all sounds good and as realistic and transparent as can be, but to be sure we checked the stones listed on Icecap against the prices listed on Rapnet, a B2B Online Diamond Market, present in 100 countries, with over 1 million diamonds listed at a value of $7.1b. As a B2B tool, diamonds are valued at wholesale price on Rapnet. Our findings showed that all stones on Icecap are listed at less than the suggested 1.50 multiple, which is great, until you learn that most stones on Rapnet are currently traded at around 50% below ‘Rap’, therefore making the stones on Icecap, very expensive.

Like with most things there are lots of additional considerations when buying and selling via a ‘new’ platform. Below are a few things we discovered on Icecap:

1. Sellers listing a stone as an NFT, are allowed to include royalty fees, in other words, every time their stone is re-sold, they are allowed to take a percentage of the sale, up to a maximum of 10%.

2. Whilst there are GIA certificates, there are no condition reports, that you would have access to, should you buy via an auction house for example.

3. There is a 1% trading fee for all NFTs on Icecap.

4. There is a fee for taking physical possession of the stone.

5. There is an annual storage fee, if you do not redeem the stone.

6. Should you redeem the stone, there are shipping and insurance considerations.

7. Sales tax will apply, should you take possession of the stone.

“We are certainly not saying that NFTs do not have a place in the diamond world – it’s not our place to say that, but what we are saying is that not everything is always as it may seem and if you are looking to invest in diamonds, there is a lot more than meets the eye. It might be described as akin to buying a beautiful old property, without having the relevant searches done, only to find out later that you overpaid, there’s hole in the roof and you don’t own the freehold” added Philip Baldwin, Co-founder and Joint Managing Director, Amma Group.

In theory, NFTs certainly look like an interesting proposition, but in reality, everybody has to make money and therefore it is not surprising to see that prices are higher than they ordinarily would be.

“There are two things that concern us most: there seems to be trust in a platform and the sellers on that platform, without physically even seeing the diamond; and secondly should this form of trading really take off, diamonds may never see the light of day again, and instead will be kept in a safe and purely traded back and forth, and that would be incredibly sad,” ended Makhzani.

Set up 14 years ago, Amma Group is a fancy coloured diamond fund manager with over 60 years of experience in the diamond and luxury sector. Open only to qualified purchasers and accredited investors, Amma Group believes that something of such high value and with general market opacity should not be traded by people or to people without the knowledge and expertise of fancy coloured diamonds, the necessary buying and selling procedures, transportation, safe keeping, insurance and naturally the financial regulations that must be followed when trading in this asset class.

Sotheby’s 101.38 ct. D colour flawless diamond sells to a cryptobuyer

Diamonds: Navigating An Opaque Market

A diamonds transparency and brilliance are what make it so alluring, yet much of the global diamond industry is hidden behind a veil of mystery.

As an alternative investment fund Amma Group specialises in fancy-coloured diamonds. Working within collectible investments, Amma Groups funds are open to qualified investors.

From mine to retailer, a diamonds journey may take it across numerous continents and through many hands. Mines use the tendering process to sell coloured diamonds, with organisations first being invited, before being requested to make a sealed bid, with the results achieved kept confidential.

Diamond Tenders

Recently announced was Petra Diamonds rough diamond tender of a 39.34 carat, blue type IIb, to be held on 12th July and estimated to be worth $64 million once cut and polished. However, one of the most renowned tender processes was the annual Argyle pink diamond tender. Now depleted the Argyle mine in Australia contributed to over 90% of the world’s pink diamonds.

Closed in 2020, Argyle Pink Diamonds will hold its final tender in September 2021. In their own words, an event widely regarded as the most exclusive diamond sale in the world. Offering between 50 and 70 stones these are Argyle’s largest and most vivid pink, red and violet diamonds, representing less than 0.01 percent of diamonds ever unearthed from the mine. Headlining will be the 3.47ct Eclipse Fancy Intense Pink diamond and notably the largest ever offered at tender.

With the closure of the mine, has come a new venture from an Australian company selling pink diamonds pertaining to be of Argyle origin. Described as the world’s first public tender of secondary market Argyle Pink Diamonds it will be held in July 2021. Open to anyone, the tender will follow the same format of sealed bids, however the catalogue appears to have numerous inconsistencies, namely a lack of Argyle Certificates or in many cases recent GIA certificates. Ordinarily in addition, a tender would be highly regulated with an independent organisation brought into verify the process.

Mahyar Makhzani, Joint Managing Director and Co-Founder of Amma Group commented, “We offer full transparency on the diamond market to our investors; even providing all purchase and sales information. We also never buy a diamond with a GIA certificate older than 6 months. Alas GIA does not provide provenance of a stone, however Argyle Pink Diamonds are always sold with an Argyle Certificate – we would certainly question the validity of any stone claiming to be from Australia without an accompanying certificate of authenticity.”

Diamond Auctions

Buying and selling diamonds at auction offers greater transparency. As a trusted facilitator of the sale, the consumer can feel assured of the diamonds legitimacy and be guided by a price dictated by historical performance. And whilst demand during the sale often results in a price higher than estimated, the bidding process is entirely visible.

Most notable recent sales of coloured diamonds at auction have included the 204 carat Fancy Intense Yellow, named the Dancing Sun diamond which sold for $4.95 million at Christie’s New York in June 2021.

In May 2021, the 15.81ct Sakura diamond, sold for $29.3 million at Christie’s Magnificent Jewels, Hong Kong, setting a world record auction price for a purple-pink diamond.

Cryptocurrency and NFTs

To add a further twist to the story, the key auction houses have recently announced that they will accept cryptocurrency as payment for diamonds. Whilst still transparent, this brings them a step closer to NFTs (non-fungible tokens) which have recently hit the auction artworld by storm. An NFT is created using blockchain technology to facilitate tracking information; tracing the supply chain from diamond mine to manufacturer and retailer, is becoming more commonplace and helps to eliminate conflict diamonds from the market, safeguard livelihoods and minimise the environmental impact of mining operations. But is the world of luxury ready for NFTs to be used as a form of currency? With artwork, over and above the collectability, there is a certain amount of objectivity, whereas with expert knowledge, the accurate valuation of a diamond is possible.

It’s clear that understanding the coloured diamond market is complex and with much of the industry hidden from public view, whether you are a family office, private wealth manager or institutional investor, using a fund manager with diamond industry knowledge is paramount.

“As the fund is so highly regulated, the real opportunity for our investors comes from our ability optimise market value by creating pairs and sets or by re-polishing stones to improve clarity and colour. A great example of this was a 5ct fancy deep pink with a section of deeper colour. After re-polishing, the stone was re-certified as a Fancy Red, the most valuable of coloured diamonds and achieved a gross multiple of 6.6x,” added Philip Baldwin, Joint Managing Director and Co-Founder of Amma Group.

To find out how you can add coloured diamonds as an alternative investment to your wealth portfolio, please click the button below.

The Dancing Sun

The 204.36-carat “Dancing Sun” fancy intense yellow diamond, sold for $4.95 million.

Christies, New York

The Sakura Diamond

An 15.8-carat purple-pink diamond set on a platinum and gold ring, sold for $29.3 million.

Christie’s Hong Kong

Sapphires Shine in Geneva

Geneva was the location for this years May Magnificent Jewels auctions, with sapphires steeling the show and exceeding top estimates.

With a 55.19 carat, blue colour (medium-strong to strong saturation) Kashmir sapphire, the biggest ever to be auctioned, exceeding its top estimate of $2.8 million and achieving an astounding $3.529m at Sotheby's. Head of Magnificent Jewels Sales at Sotheby’s Geneva, Benoit Repellin, said “Kashmir sapphires are among the rarest coloured gemstones known to man. These gems have over the years acquired an almost legendary status.”

Whilst Kashmir sapphires are far rarer than those from Ceylon, both shone at Christie’s and Sotheby’s with all lots exceeding their top estimates.

What Makes Kashmir Sapphires So Rare?

True Kashmir sapphires are extremely rare due to the short period of time they were mined from the original deposit, known as the “Old Mine”. They have a blue colour that is deeply saturated and bright, with a velvety transparency, caused by tiny inclusions scattering light within the stone. Alas few sapphires originating from later mines compare to the quality of the "Old Mine" sapphires.

The best quality sapphires possess a vivid, fully saturated blue colour and the most coveted is known as “royal blue.”

Nowadays, very few truly high-quality Kashmir gemstones are available on the market. It is the uniqueness of their appearance combined with their rarity which make Kashmir sapphires so highly desirable.

The famous ‘Jewel of Kashmir’, a 27.68 carat sapphire was sold at auction in 2015 at Sotheby’s in Hong Kong for a record per carat price of US$242,145.

Sapphire and Diamond Brooch

Formerly in the Collection of Maureen Constance Guinness, Marchioness of Dufferin and Ava, a 55.19 carats and 25.97 carats Kashmir Sapphire and Diamond Brooch.

Sotheby’s

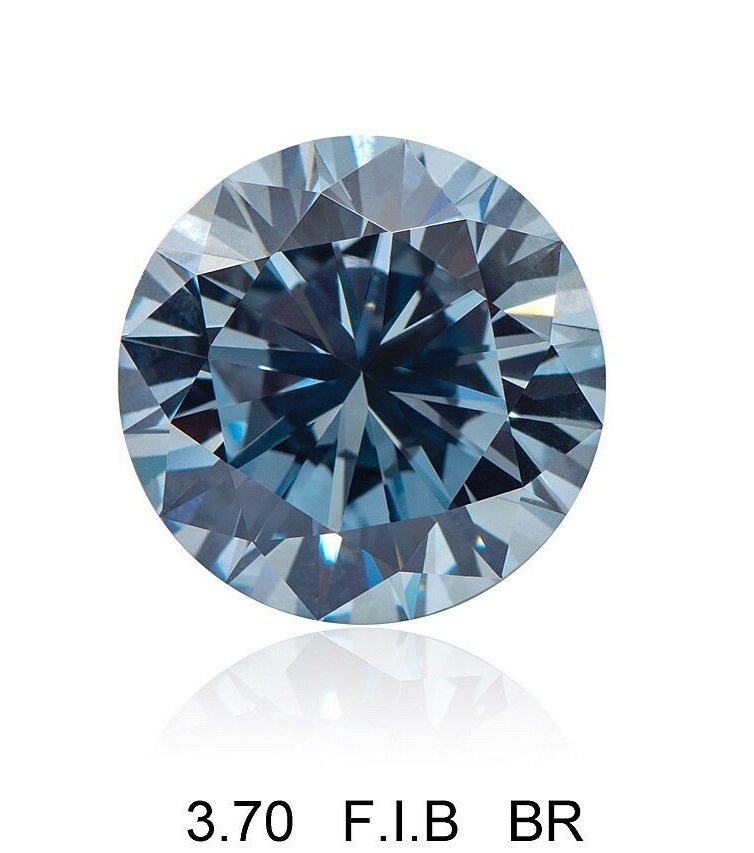

Non-Fungible Token Fancy Coloured Diamonds - Really?

After more than 12 months of relative inactivity, fancy coloured diamond prices are on the up according to data from the Fancy Colored Diamond Research Foundation (FCDRF), which shows changes in the wholesale price of all yellow, pink and blue fancy-coloured diamonds, irrespective of specific classifications, such as clarity, cut, tone and colour saturation.

This comes at the same time as the launch of the first public global tender of secondary market Australian Pink Diamonds by yourdiamonds.com, as well as the launch of Icecaps Investment Grade Diamond Non-Fungible Tokens, which are blockchain-based tokens that document ownership of assets.

Coloured diamonds are incredibly rare; approximately 1 in every 10,000 diamonds is considered fancy coloured, as stated by the Gemological Institute of America, the worlds most trusted name in diamond grading and gem identification. However, this poses a problem for the new diamond platform-based launches, as according to WWW International Diamond Consultants, at least 5,000 carats of similar attributes need to be traded to have a reliable gauge for a stones value, which given their scarcity, is impossible for fancy coloured diamonds.

Amma Group, fancy coloured diamond fund managers with over 60 years of experience in the diamond and luxury sector, set up its first fund 13 years ago. Open only to qualified purchasers and accredited investors, Amma Group believes that something of such high value and with general market opacity should not be traded by people or to people without the knowledge and expertise of fancy coloured diamonds, the necessary buying and selling procedures, transportation, safe keeping, insurance and naturally the financial regulations that must be followed when trading in this asset class.

Coloured diamonds range from brown, which is mostly used for industrial purposes, to yellow, through to orange, green, pink, blue, purple and the rarest of all, red. Of these colours, each is further classified by its intensity and depth of colour, the best of which is fancy intense to fancy vivid.

Unlike white, also known as colourless diamonds, whose increased value is attributed to the lack of colour, coloured diamonds attribute their value to the presence of colour, with fancy intense to fancy vivid being the most valuable.

“It takes in-depth knowledge and skill to know what you are dealing with.” said Mahyar Makhzani, Joint Founder and Managing Director of Amma Group. “For example, take a 1 carat Light Pink and a 1 carat Fancy Vivid Pink, assuming all other characteristics are the same, there could be a price differentiation of 100 times.”

Philip Baldwin, Joint Founder and Managing Director of Amma Group added “We only ever buy and sell stones with certification that is no more than 6 months old. Even as experts, seeing a certificate is just part of the story. We also ensure a realistic net asset value ‘NAV’ by gaining valuations from three independent coloured diamond experts on a quarterly basis.”

Fancy coloured diamonds are a natural and therefore exhaustible resource. With scarcity and rarity constantly increasing, prices at auction have shown a steady rise over the last decade and more. This combined with over 60 years of knowledge and skill along with some interesting buying and selling strategies have resulted in Amma Group receiving some notable recommendations with one client saying, “The Coloured Diamond Fund produced impressive returns with the additional attraction that they were not correlated to those of traditional mainstream asset classes.”

Makhzani went on to say “We bought one stone, with a per carat price of $500,000. We thought that if we re-cut and polished it, in other words, reduced its size, we might be able to achieve a better, more intense colour. We did just that; it was re-certified and sold for a per carat price of over $3.5m.”

With the depletion and subsequent closure of the Argyle mine in Australia, which was the source of 90% of the world’s pink diamonds, prices for one of the rarest of coloured diamonds are expected to increase, but as Baldwin ends, “With such opacity in the coloured diamond market, you really have to be knowledgeable about what you are buying and from whom.”

Pink Diamond Colour Scale by Scarcity & Value

The graph shows how scarcity and value are impacted across the colour scale spectrum.

The Argyle Prima© Fancy Red Pear Shaped Diamond

Previously under management by Amma Group

Resurgence in Sales of Coloured Diamonds

After a period of uncertainty as a result of the global pandemic, Christie’s Magnificent Jewels auction, held on the 13th April in New York, was the setting for what is hopefully a resurgence in the sale of fancy coloured diamonds.

Christies reported global participation with bidders hailing from 40 countries across 5 continents. Leading the auction was a trio of fancy coloured diamonds, described as the “Perfect Palette.” The pink, orange and blue diamond rings were sold separately but altogether achieved a total of $8.4 million, surpassing the top estimate.

The 2.17 carat Fancy Vivid Purplish Pink, cut cornered square, had a top estimate for $2.5 million and sold for an incredible $3,510,000. The arguably rarer, 2.13 carat Fancy Vivid Blue cut-cornered rectangular diamond, sold just shy of its top estimate at $2,670,000 and the 2.34 carat Fancy Vivid Orange cut-cornered rectangular diamond, sold for $2,190,000.

“Coloured diamonds are exceptionally rare and with the relatively recent closure of the Argyle Mine, which was the source of approximately 90% of the worlds pink diamonds, it is no surprise that the purplish pink sold above the price of the blue diamond, despite being less rare,” said Philip Baldwin, Managing Director and Co-Founder of Amma Group.

“Fancy Coloured Diamonds are unlike almost any other luxury investment, purely because they are a finite commodity. Much like a Renoir or a Picasso, their scarcity and rarity is driven by the inability to produce anymore. This differs greatly from other man-made luxury items whose scarcity is as result of a business decision”, said Mahyar Makhzani, Managing Director and Co-Founder of Amma Group.

Achieving uncorrelated returns in a unique asset class, Amma Group is a fancy coloured diamond and precious stone fund manager.

Christies

I Choose To Exclude You!

This morning I awoke to a Tweet from the venerable and extraordinarily memorable Mark Ritson, in response to a fellow MWminiMBA cohort, who was complaining about Mark’s semi-nakedness whilst teaching the targeting module of the online Marketing MBA programme. Could this be a masterclass in the virtues of salience? Actually, in his defence, he was at that time discussing the prowess of Abercrombie & Fitch and their ability to truly nail the matter of targeting.

Whilst in general there is an understanding of targeting, alas far too many marketing professionals and agencies offering guaranteed success, prefer to focus their talents on the glamorous and creative side of our profession opposed to getting their hands dirty and doing the work that has greater assurance of long-term results. At times, all business professionals discuss their target audience, but how do they define who that person is, and based on what criteria?

In recent years, avatars and personas have become commonplace, with a lot of digital agencies defining organisations ideal ‘target audience,’ however these, in the most part are based on an assumption of the market place with very little knowledge or evidence. For targeting, is part of the Holy Trinity of marketing - three distinct elements that only work, when they come together as a threesome - Segmentation, Targeting and Positioning.

Segmentation is based on real life consumer research. It places people in groups that share commonalities based on values, beliefs and behaviours, but much more than this, done correctly it allows the company to understand the size and value of each group, its market share within the group and therefore the opportunity to grow. So what?

Targeting is the seemingly simple, yet inextricable process of deciding which segment to choose. And choose is what you must do. So, say to yourself, “I choose not to include you.” “I choose not to invite you.” “I choose to exclude you.” And now, we are talking good marketing.

So, I hear you say, what has this got to do with Abercrombie & Fitch and a semi-naked man? Back in the early part of this millennium, Abercrombie & Fitch took targeting to the pinnacle, by choosing to pay a well-known MTV reality show celebrity, NOT to wear their clothes. On the one side they could see the potential of sales to him and his followers and on the other side they could see the masses of Abercrombie fans deserting the brand as a result of their lack of association with the celebrity.

A vital part of the targeting process is to understand the positive and negative influences one segment may have on another. Much like a maze, there are routes that trap you, and routes, which lead you to another area and ultimately to success. In choosing a single segment, you want to also find a group that can sway others to their way of thinking. In doing this, your marketing budget and efforts are kept tight and efficient, with positive influencers playing a critical role in the communication process.

And now you have chosen whom not to target, you must focus all of your efforts on who to target. Armed with your research responses from all the participants within your chosen segment, its time to create a true reflection of the person you want to become your customer. What do they look like? What are their beliefs and opinions about you? Who do they say are your competitors? What do they like most about you? What do they like least about you? What do they think, when they think of you? It’s only now you have a true avatar, segment portrait or persona.

Working within the luxury and financial sectors, Amma Advisory offers elegant solutions which bridge companies’ knowledge gaps. Providing analysis and advice on creating solutions that have a positive, long lasting impact on your business, whilst ensuring your team learns the new-found skills to continue your aspirations.

Our team is skilled across many departments, providing expertise on strategy, finance, marketing, stock, distribution and sales. Our end goal for you is extremely focused: increased gross margin, revenues and growth. For more information on how we can help you meet your goals contact us at enquiry@amma-group.com

14.83 Carat Purple-pink Diamond Sells for $26.6 Million

Hot off the back of the closure of the famous Argyle mine, world renowned producer of around 90% of all pink diamonds, comes the auction of an ultra rare, vivid purple-pink diamond mined in Russia and selling yesterday at Sotheby’s Geneva for an incredible $26,612,763.

This stunning stone was unearthed by diamond producer Alrosa based in the Sakha region of Russia, in July 2017. It took over a year of true artistry and unparalleled passion to expose its inner beauty and create the 14.83 carat oval diamond, named ‘The Spirit of the Rose’.

It is the largest of its kind (colour, clarity and cut) to be offered at auction. "The occurrence of pink diamonds in nature is extremely rare in any size. Only one percent of all pink diamonds are larger than 10-carats," said Gary Schuler, worldwide chairman of Sotheby's jewellery division.

Head of fine jewellery auctions at Sotheby's Geneva, Benoit Repellin, commented that the oval-shaped diamond was "completely pure." And according to Repellin, five out of the 10 most valuable diamonds ever sold at auction were pink.

Record-breaking gems

Highest price record: The world auction record for a diamond or any gemstone or jewel was the "CTF Pink Star", a 59.60 carat oval pink diamond that sold for $71.2 million in Hong Kong in 2017, after just 5 minutes of bidding.

Highest price per carat: In November 2013, Christies sold the largest vivid orange diamond in the world for $35m for a record-breaking $2.4m per carat.

Most expensive precious stone: In May 2015, a 25.59 carat “pigeon blood” Burmese ruby named the Sunrise Ruby, sold for a staggering $30m, making it the most expensive precious stone other than a diamond.

Rare Fancy Purplish-Red Diamond Sells Above Estimate

A 1.05 carat fancy purplish-red cut-cornered rectangular shaped diamond sold at Christies Geneva yesterday, the 10th November for $2.74 million, almost a million above its high estimate of $1.85 million. The stone with VS2 clarity, was mounted on a simple platinum and gold Graff ring and was flanked by 2 heart shaped white diamonds.

Also selling at the auction was a 3.96 carat fancy deep blue pear-shaped diamond ring which went within estimate, for $1.73 million; and a 16.45 carat Kashmir sapphire which sold for $789,570, almost one hundred thousand dollars above its top estimate.

The on-going results of auctions that have taken place during the pandemic, continue to prove that the rarest of rare are a commodity which holds its own, during economic downturn.

The Argyle Mine Ceases Operations Today

After 37 years and more than 865 million carats of rough diamonds, a very small proportion of which have been pink, the Argyle mine will finally close today.

The Argyle mine has been the source of 90 per cent of the world's pink diamonds over the last thirty years and in that time, pink diamonds have gone up in value by more than 500 per cent. Rio Tinto's managing director for operations, copper and diamonds, Sinead Kaufman said "Demand for Argyle pink diamonds has continued unabated. Rarity, uniqueness and a finite supply has driven the strong value appreciation we have seen, and continue to see."

Described by Vivienne Becker, award winning jewellery writer and historian, as having "a colour and quality that had never been seen before." Much like white diamonds, coloured diamonds are categorised according to their colour which range from very light through to vivid and intense - the more vibrant and intense the colour, the rarer and therefore, the more valuable. What has made Argyle Pink Diamonds so extraordinary is the sheer number of stones with the richness and vibrancy of colour, sitting in the far end of the colour spectrum. "It was completely unprecedented and there was massive excitement in the industry," said Becker.

Mahyar Makhzani, Managing Director and Co-founder of Amma Group commented that we expect prices to climb further after the mines closure. "Pink diamonds have out-performed virtually all traditional asset classes over the past 10 to 15 years," he said. "They've done better than the stock market, property, precious metals and really do present a very stable asset class.”

"The market has known for a long time now that the mine is closing so I don't think we're going to see any shock movement but certainly in a year or two the supply squeeze will start to be felt quite significantly and we’ll expect to see pink diamonds really increase in value. It would be true to say that if you have an Argyle Pink Diamond, then you should hold onto it, but if you are looking to invest, do it now rather than wait a couple of years," said Makhzani.

The land that these diamonds originate from is well known to be sacred land and as Vivienne Becker mentioned, "A huge part of the appeal of these diamonds is the provenance, the purity and integrity of the provenance."

"We've lived through the life of this mine, right from the start, and in these days, when people are really concerned with the origins of every product they buy, particularly luxuries, then this has been a very important element," she commented.

The term conflict diamonds is well known and for a long time now, mines have signed up to the Kimberley process, ensuring diamonds are conflict free. However less well known are the environmental, social and governance (ESG) concerns surrounding the industry. In a desire to ensure traceability of its diamonds, Amma Group has recently partnered with The Loudhailer to support and connect digital futureshapers whose innovations might address these concerns.

“With an intention to work with partners to improve social, economic and environmental factors within the diamond and precious stone industry, Amma Group through is partnership with The Loudhailer is developing a fund structure to further support winners of the African based Global Startup Awards, also providing the business tools needed to succeed. Inevitably these digital disruptors will pave the way in addressing climate change, sustainability metrics and energy”, said Philip Baldwin, Managing Director and Co-Founder of Amma Group.

Amma Group has been one of a handful of organisations around the world that are invited to the yearly Argyle Pink Diamonds Tender - the chance to bid on stones from the Argyle mine, 2020 being its penultimate Tender. The process follows the format of a blind auction; organisations have a limited time frame in which to present their best and final offer on a stone in the hope that they come out on top. Amma Group has been fortunate enough to have purchased a number of stones from the Tender, over the last decade.

The Argyle Mine will close today, Tuesday 3rd November and Rio Tinto will begin a five-year process to decommission it before returning the land to its Traditional Owners.

In celebration of the the Argyle Mine and its treasure trove of pink diamonds, below is a wonderful podcast from The Sydney Morning Herald, Good Weekend Talks.

Thank you Argyle Pink Diamonds; ours is the richer for having known you!

Amma Group Announces Its ESG Intention With Launch of New Partnership

The term conflict diamonds is well known and for a long time now, mines have signed up to the Kimberley process, ensuring diamonds are conflict free. However less well known are the Environmental, Social and Governance (ESG’s) concerns surrounding the industry.

In a desire to only work with organisations that are respectful of the environment, ensure positive social impact and gender equality, within a framework of governance, Amma Group has created a longterm ESG intention.

To team up with partners to create an ecosystem that aims to improve social, economic and environmental factors within the diamond and precious stone industry by 2030.

During the formation of its ESG goal, Amma Group was introduced to The Loudhailer, the African partner for the Global Start Up Awards. The African continent makes up around 40% of all diamond production. In a desire to ensure traceability of our diamonds, Amma Group has partnered with The Loudhailer to support and connect digital futureshapers whose innovations might address the ESG concerns surrounding the diamond mining industry.

“In looking for a partnership, it was important to Amma Group that we worked with an organisation that promoted innovation, self-sufficiency and growth, but also looked to ‘challenge the norms’ - all principles that have helped to shape our organisation”, said Mahyar Makhzani, Managing Director and Co-Founder of Amma Group

“With an ESG intention to work with partners to improve social, economic and environmental factors within the diamond and precious stone industry, Amma Group through is partnership with The Loudhailer is developing a fund structure to further support winners of the African based Global Startup Awards, also providing the business tools needed to succeed. Inevitably these digital disruptors will pave the way in addressing climate change, Environmental, Social and Governance metrics and energy”, said Philip Baldwin, Managing Director and Co-Founder of Amma Group.

Celebrating 13 Years

In 2007 the likes of Facebook, LinkedIn and Twitter had just begun their journey; the first iPhone was less than a year old and many organisations were still grappling with the transition from paper to email.

In that same year, in the midst of the ‘Global Financial Crisis’, Philip Baldwin and Mahyar Makhzani both with extensive experience in the world of luxury, decided to set up their first Fund specialising in fancy coloured diamonds, targeted at qualified investors.

“It was the strong demand in coloured diamonds combined with a general opacity and inefficiency in the pricing of these alluring stones which compelled us to set-up Amma”

13 years on and we find ourselves in the midst of another crisis, but unlike any we have seen in our lifetime. One of the founding beliefs when setting up the first fund was that due to the rarity and scarcity of coloured diamonds, they would remain strong during economic downturn. Whilst the last ten months have not only proven challenging, but have also been the downfall of many seemingly stable organisations, we are pleased to say that coloured diamonds have retained their value, as backed up by recent auction results.

Having recently celebrated our anniversary, we wanted to take the opportunity to announce the launch of our new website, social platforms and our Environmental, Social and Governance (ESG’s) intention which is ‘To partner with organisations to create an ecosystem that aims to improve social, economic and environmental factors within the diamond and precious stone industry by 2030.’

We also wanted to thank those who have helped us on our journey - to our friends at Atlas and Eclipse Consulting who didn’t shy away when we challenged the ‘norms’ of Fund Management; to Argyle Pink Diamonds, who invited our relatively unknown organisation to become part of their Tender process and to amongst others, Vivienne Becker and Robert Frank who have recognised the newsworthiness of our story - thank you!

Amma Group now also includes Amma Privé, which creates exquisite bespoke jewellery and Amma Advisory, which offers expert analytical, strategic and tactical advice for the luxury sector.

Thank you to you all,

Philip and Mahyar

View Our Social Pages

Amma Asset Management Delighted to Announce Realisation of Sciens Coloured Diamond Fund III

…the fund was completely realised with a 25% net return, over a 26 month purchase period…

Launched in Q4, 2017 and originally comprising 7 diamonds of 15.33cts, fund III included a 1.20ct, Fancy Vivid Green, Round Brilliant cut and a 1.14ct Fancy Red, Modified Rectangular cut, both of which are considered to be amongst the rarest stones on earth. Also included within the fund were three fancy blue diamonds and two fancy pink diamonds.

Since inception, the fund has predominantly outperformed the stock market and far exceeded bonds, gold and colourless diamonds.

With one stone already sold, the fund was completely realised during Q1 2020 with a 25% net return, over a 26 month purchase period, representing NAV.

The Power of a Brand

Speak to a group of luxury professionals about branding and you are likely to get a glow of pride for their organisation, followed by hesitation on how to pin-point just exactly what branding represents. The fact of the matter is that we are all susceptible to the power of a brand, and with branding being the most important single financial asset a company owns, you can ill-afford to neglect it. Furthermore, with branding directly linked to the profitability and success of a company it is something that requires on-going attention.

But what is brand equity? In short, take a product that is branded, for example a well-known fizzy drink and then take a non-branded version of the same drink. The brand equity is the difference between the value of one, versus the value of the other. Or more appropriately, the difference between a branded fancy coloured diamond ring versus the same stone alone. The setting itself can be as little as $100, but the power of the brand can increase the value of the item by up to approximately 30%. If you neglect to consistently promote the benefits and message of the branded product, it will eventually become a pure and simple commodity and the value will drop accordingly. This is particularly pertinent during times of economic downturn, when many organisations look to reduce costs. With just a 1% decrease in variable costs (or in this case, marketing expenditure), comes approximately a 6.5% increase in profitability, however, this is short-lived and can have longer detrimental effects on the brand.

The Harvard Business Reviews’ Brand Report Card by Kevin Keller suggests that by measuring how your company stacks up against 10 traits shared by the world’s biggest brands, allows you to see where improvements need to be made, to maximise profit.

Those ten traits include the benefits your company delivers, the relevancy of your message to your chosen audience and the consistency of your communication. However, over and above the 10 individual traits is one distinct attribute - positioning. Also described as what you want your prospects to think, when they think of your company, positioning is oversimplified messaging that cuts through the clutter of our over-communicated society, to get into the mind of the prospect.

Discuss branding with most people and they will say that it is about logos, fonts and colours. Some people may also include imagery and style of writing and all of these aspects would be correct, but it is so much more than this. Referred to as touch-points, every element of your identity needs to reflect the position you have chosen. And that position should be exclusive to your target audience or rather, should actively exclude anyone who is not within your target audience.

And so, how is this relevant to our industry? Take any subject matter and we will have differing and diverse opinions. In a recent project for a luxury organisation, following research, we were able to create 12 individual segments or groups of people with shared commonalities within the group and differences from the other groups. Having chosen a single group to target, we then tailored all of the marketing and communication to ‘speak’ to that group. Using words and phrases they had cited; promoting services they had expressed interest in and going as far as to include images of those who belonged to the chosen segment, allowed the company to find more people who could connect with the brand.

Amma Group works in three main areas, asset management for fancy coloured diamonds, rubies and sapphires; bespoke jewellery design for private clients and advisors to luxury goods organisations. Through our work with Amma Advisory, we are fascinated by the seemingly disparate that brings people together. We use research and analysis to find potential customers who share passions with companies’ products and services. For further information on the benefits of branding, contact enquiry@amma-group.com

Decrease in global diamond production creates demand amongst India’s super rich

It is well-known that the primary source of the rarest pink diamonds in the world, Rio Tinto’s Argyle mine in Australia, will close its operations imminently. Less well-known is the pre-pandemic expected decline of around 8% of total rough diamonds mined, starting in 2021. In Bain’s 2019 Global Diamond Industry Report, it states annual production of rough diamonds is expected to decline in Canada, Botswana, Australia and South Africa.

The anticipated reduced production, combined with the estimated 20% Covid-related drop in rough output this year, may push up diamond prices further in the near future. And with coloured diamonds representing just 0.001% of the total rough diamonds mined, the value of these exceptionally rare stones is foreseen to skyrocket as supply falls.

Indian based diamond traders have commented that the demand for Argyle pink diamonds has shot up by three times amongst high net worth Indians compared to the same period last year.

Over the last decade up to 2017, the average price paid at auction for coloured diamonds increased by 122% with Argyle diamonds demanding a further 10 - 20% on top. Argyle diamonds can reach in excess of $5 million per carat depending upon the size and clarity. The mine holds an annual invitation-only Argyle Pink Diamond Tender in which it showcases its best pink, red, and blue stones from the preceding year. Over the last decade, Philip Baldwin and Mahyar Makhzani have been invited to the Tender and have previously purchased three Argyle red diamonds, the Argyle Isla, Aurora and Prima, one of which sold with a Gross Return of 1.6x, with a 38% IRR (internal rate of return).

Cullinan Mine Unearths Five Significant Blue Diamonds

The Cullinan mine is known as the world’s most important source of blue diamonds. It is therefore very exciting to hear that Petra Diamonds has announced the discovery of five blue diamonds of high quality at its Cullinan mine in South Africa.

These rough stones are significant in size, ranging from 9.61 carats up to 25.75 carats and are assessed as being individual stones opposed to being part of one larger stone.

The last most significant blue diamond weighing 20.08 carats, was unearthed from Cullinan a year ago. “It is therefore even more unusual to recover five high quality stones around the same time, all in the space of one week’s production”, commented the mine.

Given the current pandemic, Petra Diamonds is maintaining a flexible approach to the sale of these incredible stones. And with their last blue diamond (20.08ct) selling for $14.9m USD, speculation and anticipation will be high.

Cullinan, was the source of the world’s largest gem diamond ever recovered: the Cullinan diamond weighing an astonishing 3,106 carats in its rough form, was cut to create the Great Star of Africa and the Second Star of Africa, the two largest cut diamonds in the British Crown Jewels.

Highly Anticipated Magnificent Jewels Hong Kong Auction

On October 7th, the much anticipated Magnificent Jewels auction in Hong Kong will present some of the finest of natures gifts. Rare and exquisite treasures whose journey from mine to final design has taken enormous skill, artistry and unparalleled passion.

Featuring amongst other pieces, a very rare 6.41 carat Pigeon Blood, cushion cut, Burmese ruby ring with a reserve of between $2 to $2.8 million USD and showing no gemmological evidence of heat or clarity enhancement. The stone is also accompanied by AGL Jewelfolio™ stating 'Its size, provenance and outstanding quality signify a gem ruby of unique rarity and beauty... This ruby has received one of the highest colour grade determined by AGL: 2.5... Burmese rubies of this shade and appearance are typically described as having a Pigeon Blood colour '.

The auction also showcases a number of fancy coloured diamonds including a 4.84 carat Fancy Vivid Blue, Internally Flawless, pear shape ring with a reserve of $7 to $8.3m USD.

Argyle Pink Diamonds releases one of it’s final collection Tenders.

Named One Lifetime, One Encounter, the Argyle Pink Diamonds Tender is expected to be one of its final collections before the mine’s eventual closure.

Comprising 62 loose diamonds, weighing 57.23 carats, this year’s Tender also includes additional Petite Suites - 12 sets of small pink, red, blue and violet diamonds, collected over the past five years and weighing 13.90 carats.

Within the loose stones, there are six hero diamonds including the Argyle Eternity – weighing 2.24 carats, it is the largest fancy vivid round brilliant diamond ever offered at the Tender, and the sixth largest Fancy Vivid diamond of any shape.

Arnaud Soirat, chief executive Rio Tinto Copper & Diamonds commented that “Rio Tinto’s Argyle Mine is the first and only ongoing source of rare pink, red and violet diamonds in the world. We have seen, and continue to see, strong demand for these highly coveted diamonds, which together with extremely limited global supply, supports the significant value appreciation for Argyle pink diamonds”

Amma Asset Management currently holds one Argyle diamond, a 1.14 carat Fancy Red, Rectangular Brilliant shaped diamond.

The Argyle Pink Diamonds Tender 2020 Heroes

Courtesy Argyle Pink Diamonds, Rio Tinto

With the Argyle closure looming, Ellendale provides hope for Australian coloured diamonds

Western Australia is one step closer to a new source of coloured diamonds, following a significant discovery at the Ellendale diamond field.

India Bore Diamond Holdings revealed it had unearthed a large deposit of rare diamonds on a site which had once produced half the world's supply of fancy yellows.

Ellendale exploration had been mothballed until the recent discovery which targets a riverbed formed some 22 million years ago and is estimated to contain over a million carats of gem-quality diamonds.

Most interesting is that after analysis, the stones appear to display a purple florecence under ultraviolet light, something which only occurs in around 30 per cent of diamonds and a characteristic rarely seen in fancy yellows.

Whilst yellow diamonds are typically valued at up to four times that of a white diamond of a similar size and quality, a pink diamond can reach up 50 times the price.

Alas whilst renewed exploration is very encouraging, it is unlikely that there will ever be another mine that equals the success of the Argyle.

Courtesy Rio Tinto

Internally Flawless 7.16 ct Fancy Intense Blue Diamond Sells For Over $3.8m

Christie’s New York, Magnificent Jewels auction on July 29, saw two impressive fancy coloured diamonds centre stage including an internally flawless 7.16 carat fancy intense blue pear modified brilliant-cut diamond ring, which sold for $3,855,000, and a 7.65 carat VS2 fancy light purplish pink pear modified brilliant-cut diamond ring, which after some spirited bidding sold for $819,000, well above its high estimate.

Several other gemstones achieved notable prices, including a sapphire ring of 53.48 carats, which sold for $615,000 and a sapphire and diamond necklace that sold for $325,000.

Courtesy Christies

Keeping up with the trade show developments

At the moment, it seems that not a week passes by without some news related to one watch and jewellery show or another. Following the recent departure of a number of key brands from the previously named Baselworld (now known as HourUniverse), many, including Bulgari and Girard-Perregaux, have decided to relocate to Geneva, holding their shows alongside that of the formerly named Salon International de la Haute Horlogerie (SIHH), now known as Watches & Wonders.

Dominated by the Richemont brands, the Watches & Wonders show as with many others was cancelled this year, but organisers have announced that they will be holding their first physical Shanghai based show in September 2020. Combined with a digital platform showcasing the new launches, those not able to travel will be able to see the best that the industry can offer via the internet.

Meanwhile, in a statement Fabienne Lupo president and chief executive officer of Fondation de la Haute Horlogerie, organisers of the previously named SIHH, has announced her departure after 15 years with the Swiss watch industry group. She said “I leave the Foundation knowing it is sounder than ever before, thanks to the unwavering support of its founders and partner brands.”

Credit Watches & Wonders